Book Keeping Solutions forDecentralized Organizations

Accounting and Working Capital Finance Solutions platform built and customized for needs of Web3 Start-ups and Decentralized Autonomous Organizations (DAO).

Features

Book Keeping

Accounting and Book Keeping customized to the needs to a tokenized blockchain projects and Decentralized Autonomous Organizations (DAO’s).

Treasury Management

Smart Contract Powered Receipts, Payments and Asset Tracking for better Cash flow and Treasury Management.

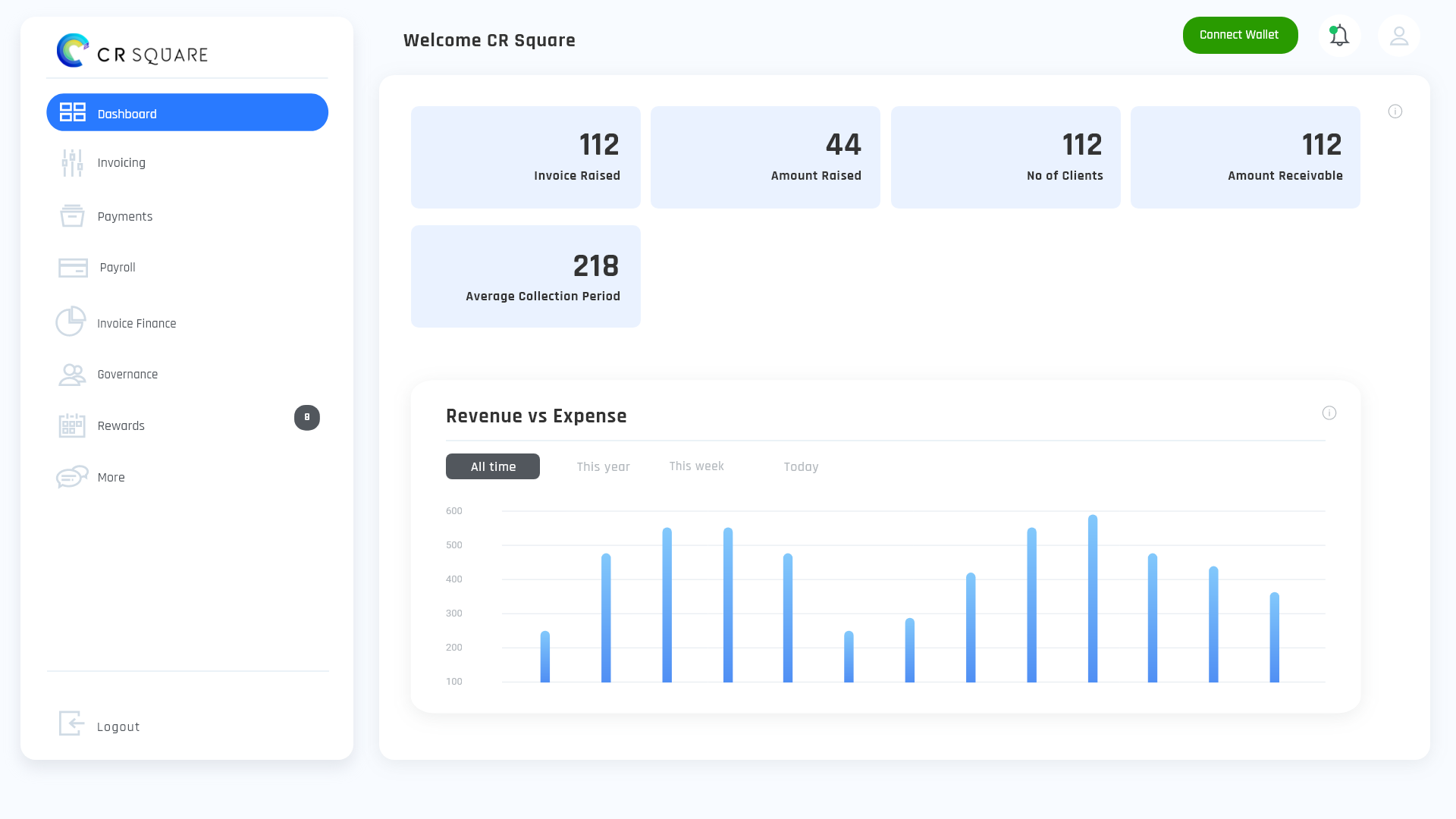

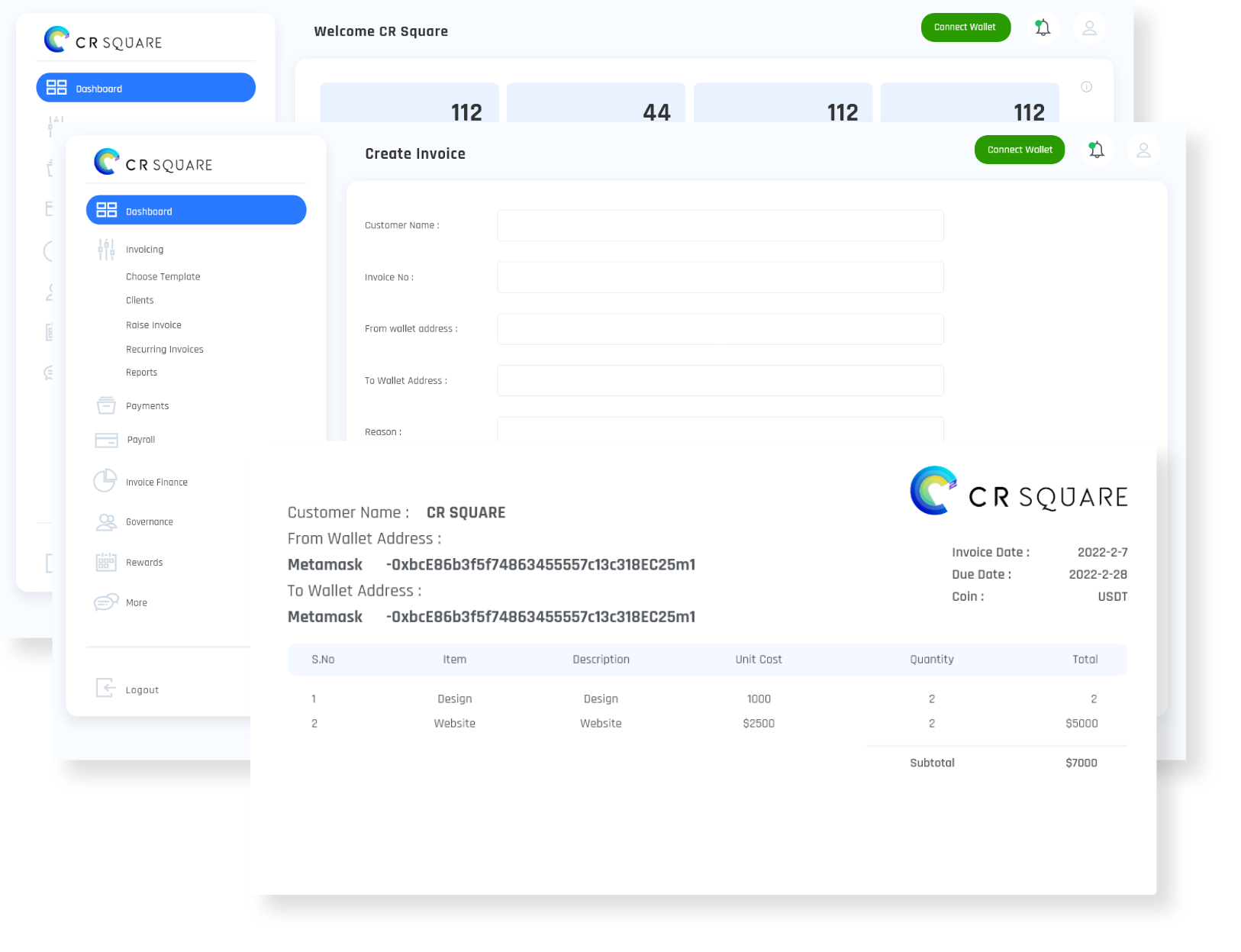

Customizable Dashboard

A Dashboard defined for the needs of Web3 Start-ups and Decentralized Autonomous Organizations (DAO’s), unlike the traditional Start-ups.

Working Capital Finance

Working Capital Finance for Web3 Start-ups for Vendor and Payroll Payments under Decentralized Finance Model.

Native Token Collateral

Web3 Start-ups can list their native tokens as collateral subject to CR Square Finance DAO approval.

Credit Rating system

A Comprehensive credit rating system based on transaction data of the users used as qualification for uncollateralized loans.

Uncollateralized Loans

DAO approved zero collateral or lower collateral loans subject to user’s credit rating system.

Incentives

Earn CR2 tokens as rewards while using DEFI Books platform.

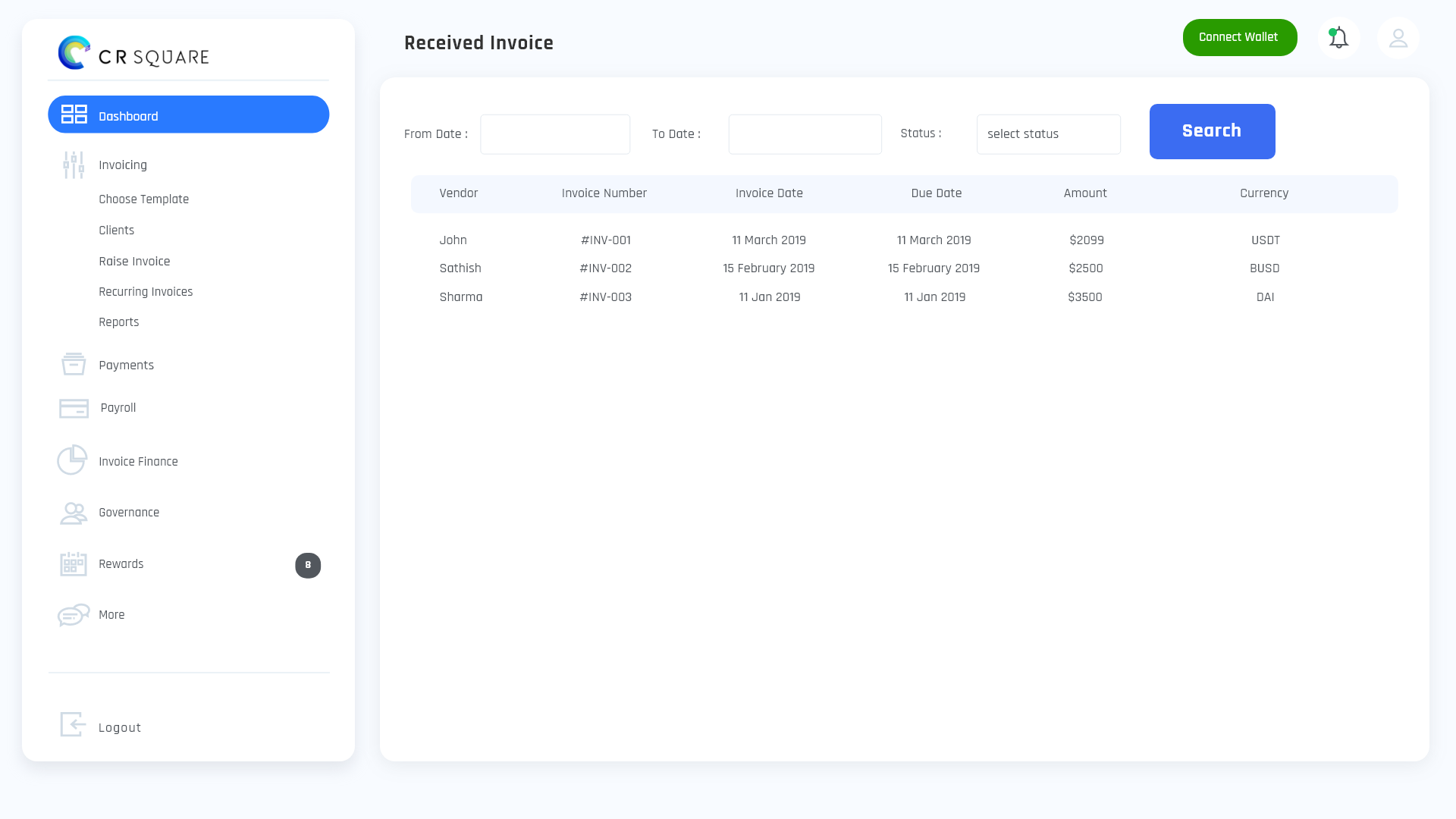

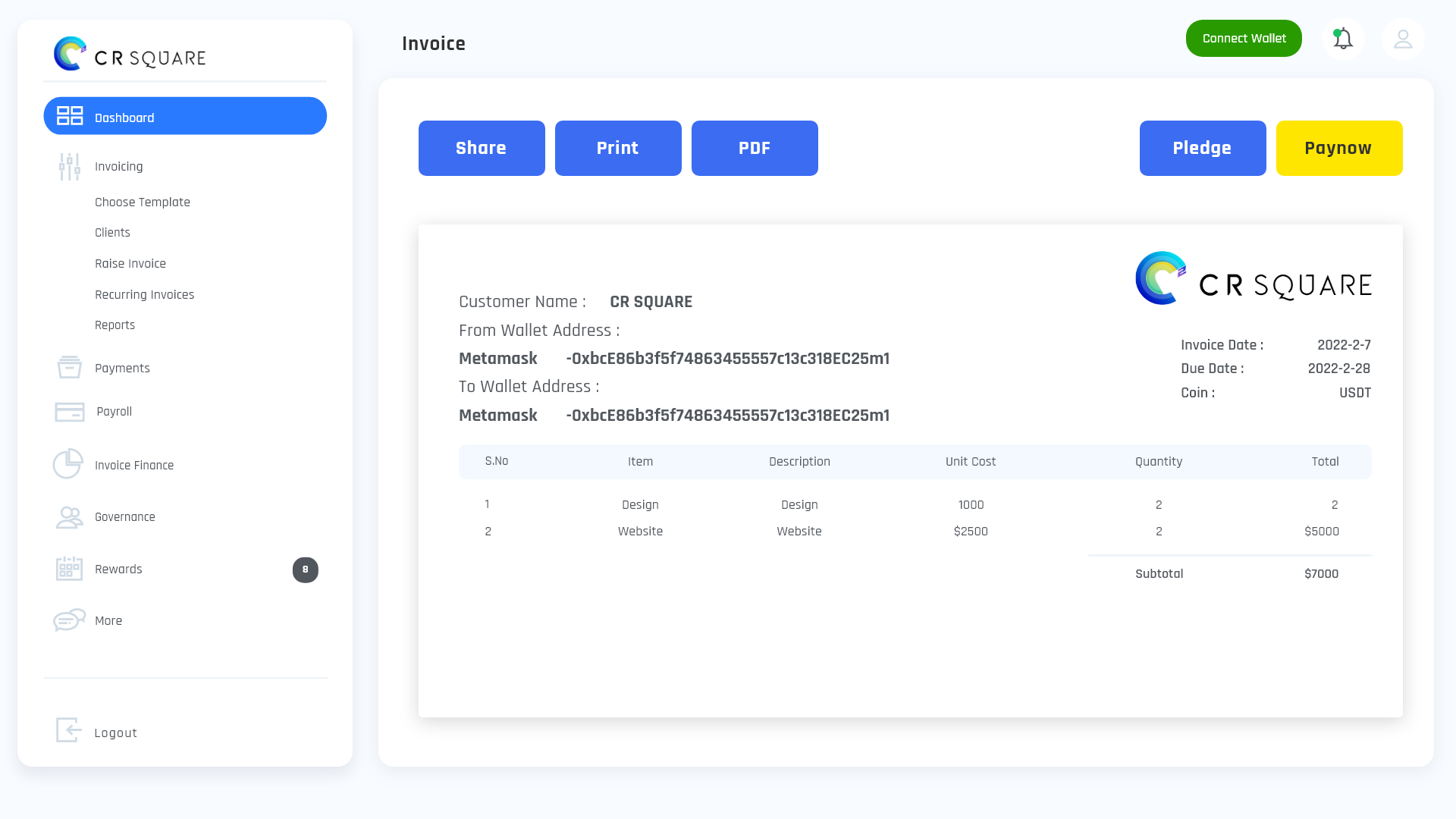

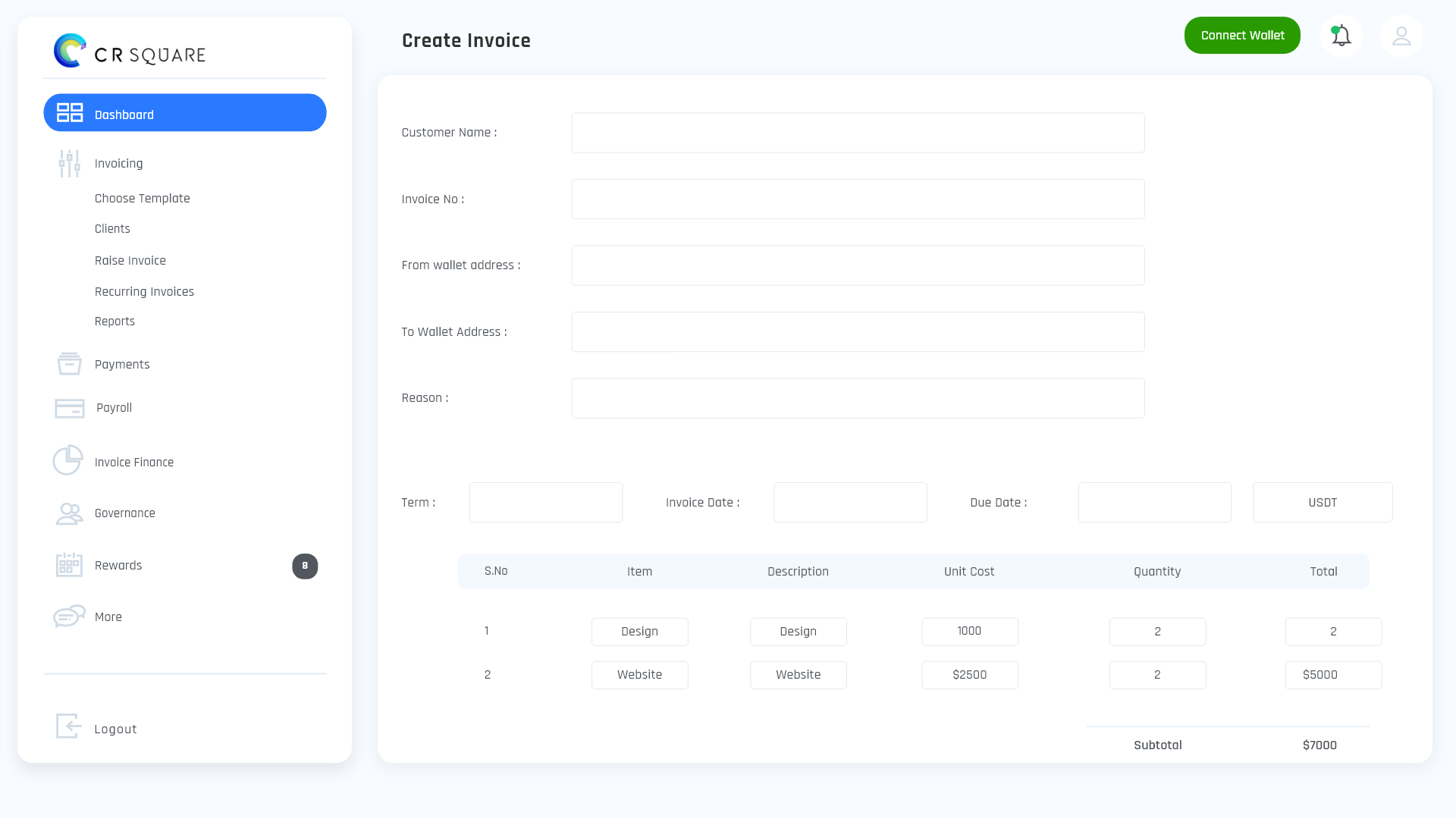

Raise Invoice of your Choice

Raising secure invoices on blockchain and offer your customers pay in crypto fiat. Take your business beyond the borders. Transact in multiple currencies with options to add more

Design

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Webflow

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Development

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Animations

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Figma

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Illustrations

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Accounting Practices

Web3 Start-ups functioning a decentralized model cannot operate of existing generally accepted accounting practices (GAAP) and need to have customised accounting practices and bookkeeping solutions to record their expenses and payroll including asset tracking and visualization which will enhance their treasury management capabilities.

Future Ready

DeFi apps require “DAOs,” or Decentralized Autonomous Organizations, to operate. DAOs manage DeFi apps through the individual decisions made by decentralized validator nodes who own or possess tokens sufficient in amount to approve blocks. Unlike joint stock companies, corporations, limited partnerships and limited liability companies, however, DAOs have no code (although, ironically, they are creatures of code). In other words, there is no “Model DAO Act” the way there is a “Model Business Corporation Act.” DAOs are “teal organizations” within the business organization scheme theorized by Frederic Lalou in his 2014 book, “Reinventing Organizations.” They are fundamentally unprecedented in law. It’s time for legislation and regulation to follow where the technology is taking us.

Native Token Collateral

There are more than 18,000 tokenized blockchain projects across the world. Typically, these projects exhaust the seed funds raised for the development of the project in a span of 12-18 months, after which the teams sell their allocated tokens in the open market to fund development of the project, which in turn leads to fall in the price of the token, devaluation of the project and the impact is considerably higher during a bear market. In the Blockchain space the project attracts more adopters as long as the price of the token appreciates in value, selling of team tokens create adverse impact on the adoption of the project. CR Square Finance provides an opportunity for these projects to list their native token as collateral subject to CR Square Finance DAO approval. Tokenized Blockchain projects can find a breather in making regular payments for their development expenditure including salaries, rent, marketing and other costs. The Blockchain Project has to in turn compensate the DAO gCR2 holders with an airdrop of their tokens for getting their token listed.

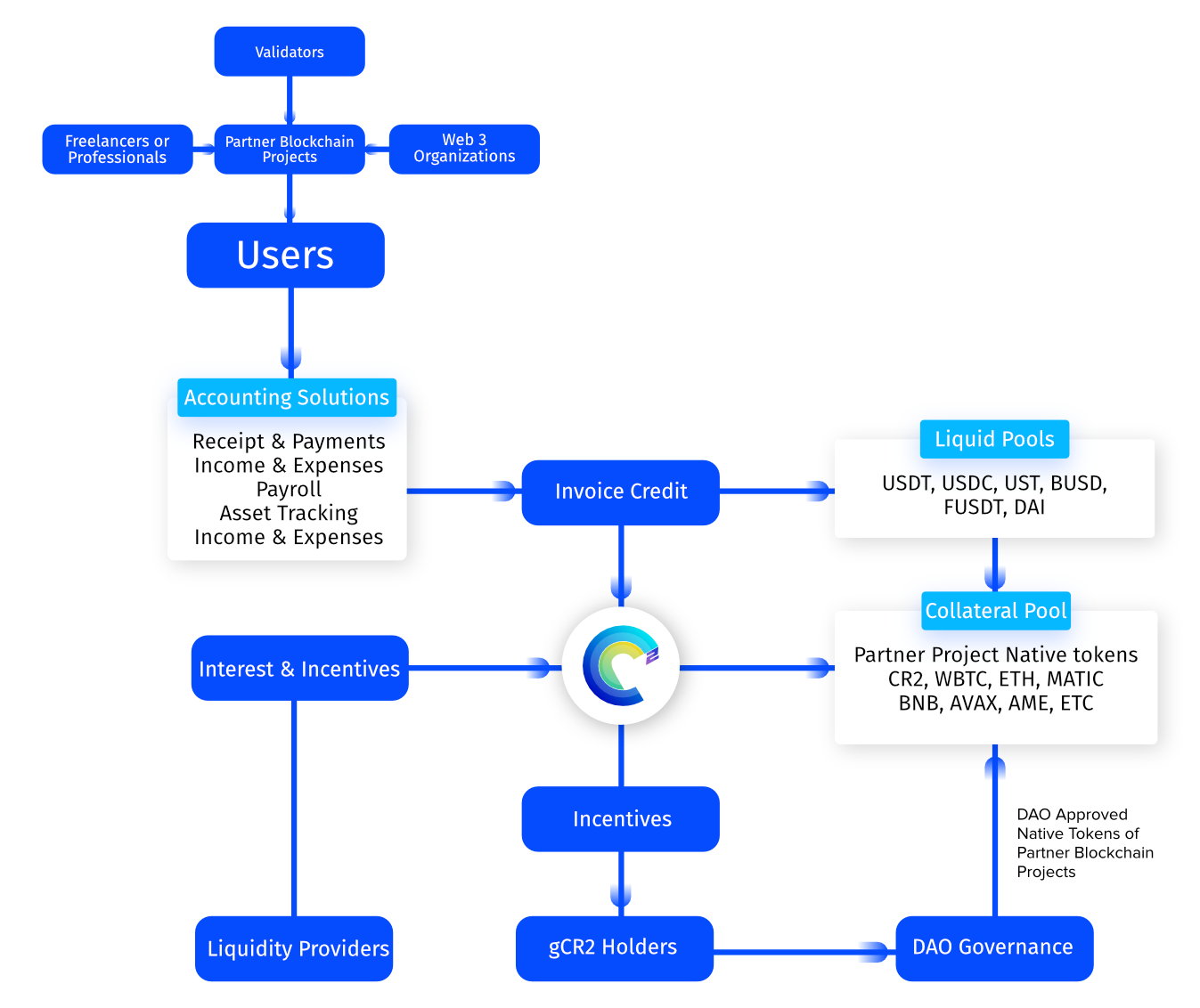

Process Flow

Follow latest protocol News !

Stay tuned to the developments and progress of the CR Square Ecosystem.