Truly Decentralized Funding Platform for Web3 community

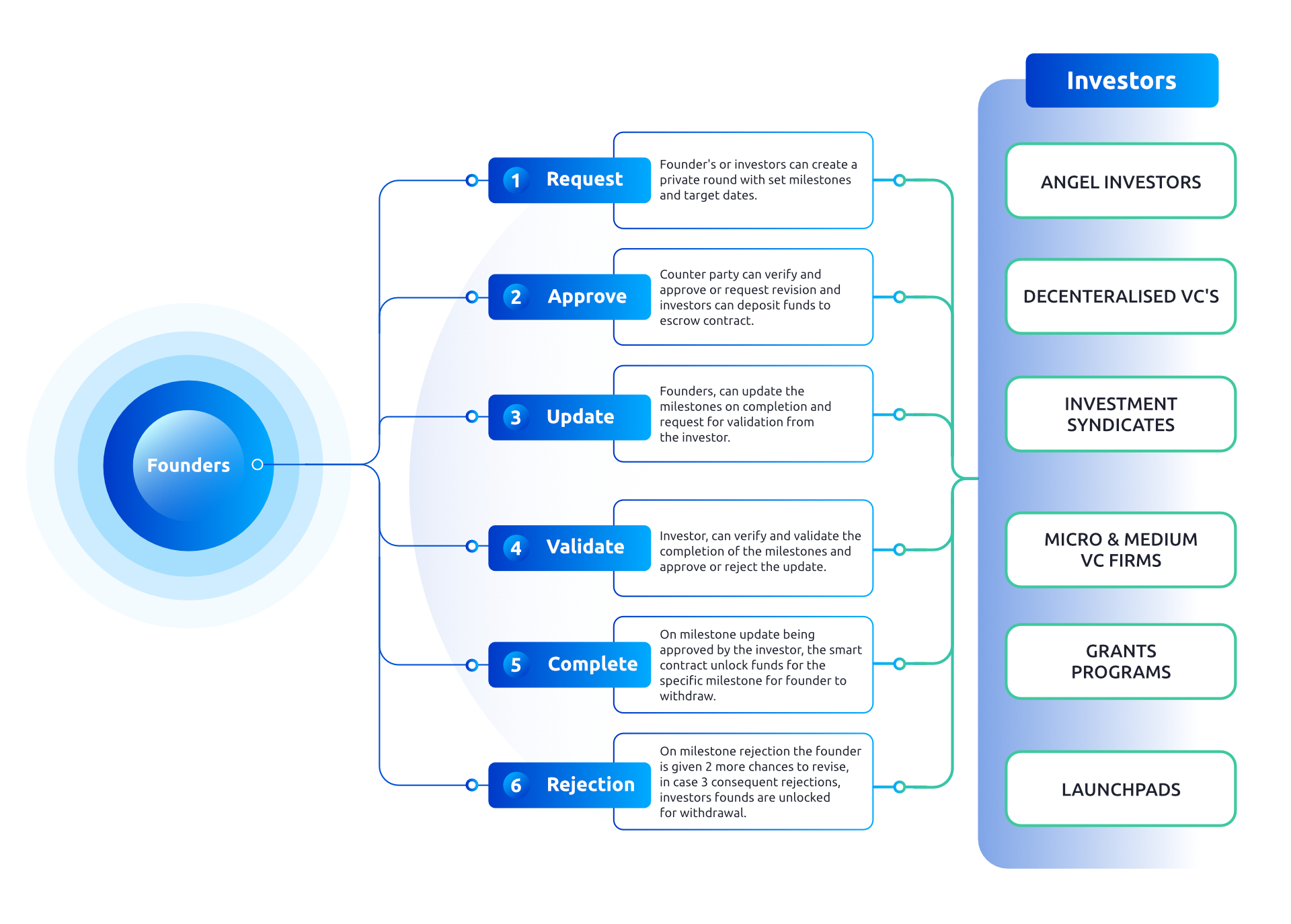

A next generation funding platform which provides a safe route of investment for Investors to invest in next generation web3 startups. Founder's can make connections with investors and raise funds based on completion of pre determined milestones. New projects and ideas get full funding, while at the same time protecting the investors from misuse of the investment.

Features List

Staged Financing

Stage wise release of funds as per pre-approved budgets and actual expenditure reporting

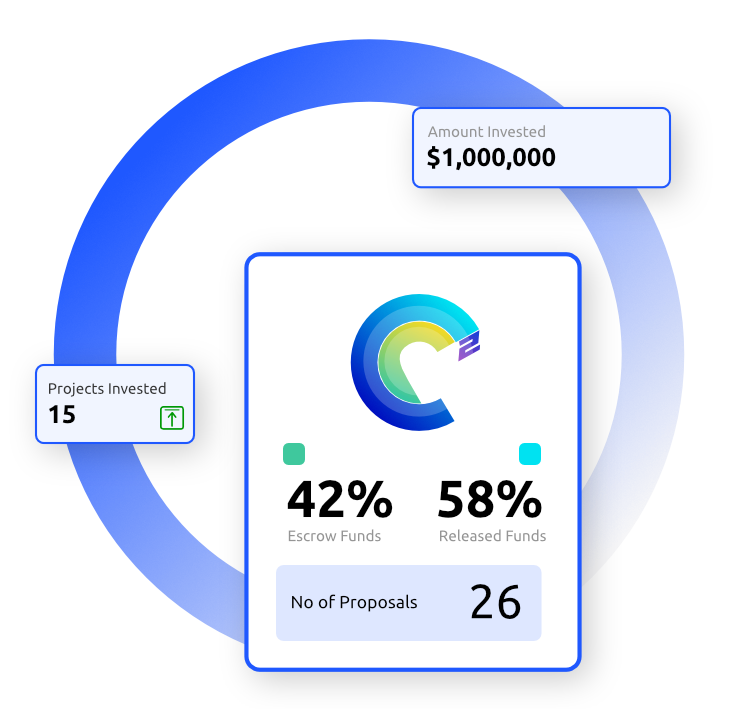

Escrow Pools

Funds stored in smart contract powered escrow pools establish trust to both Investors and Founders.

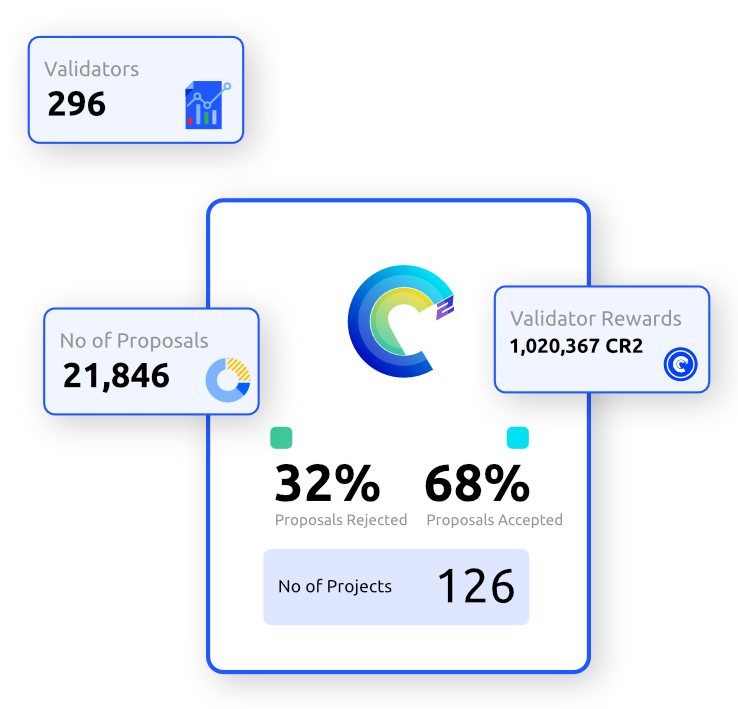

Independent Validation

Experienced personnel in blockchain industry approving or rejecting funding request proposals without any bias based on majority consensus.

KYC Validation

Founders KYC Validation, limits fraud that result mainly due to hiding of identity eliminating the risk of rug pulls and exit scams.

Project Scoring

Scoring System based on Data, Feasibility and Reporting, enhances the founder's fund raising capabilities among Investors.

Insure & Hedge

Options to Insure and Hedge Investments made through CR Square Guardian Platform for Investors.

Features

Milestone Funding

Funds would be released to investors upon successful completion of pre determined milestones recorded at the time of creation of the smart contract.

Founders - Investors Connect

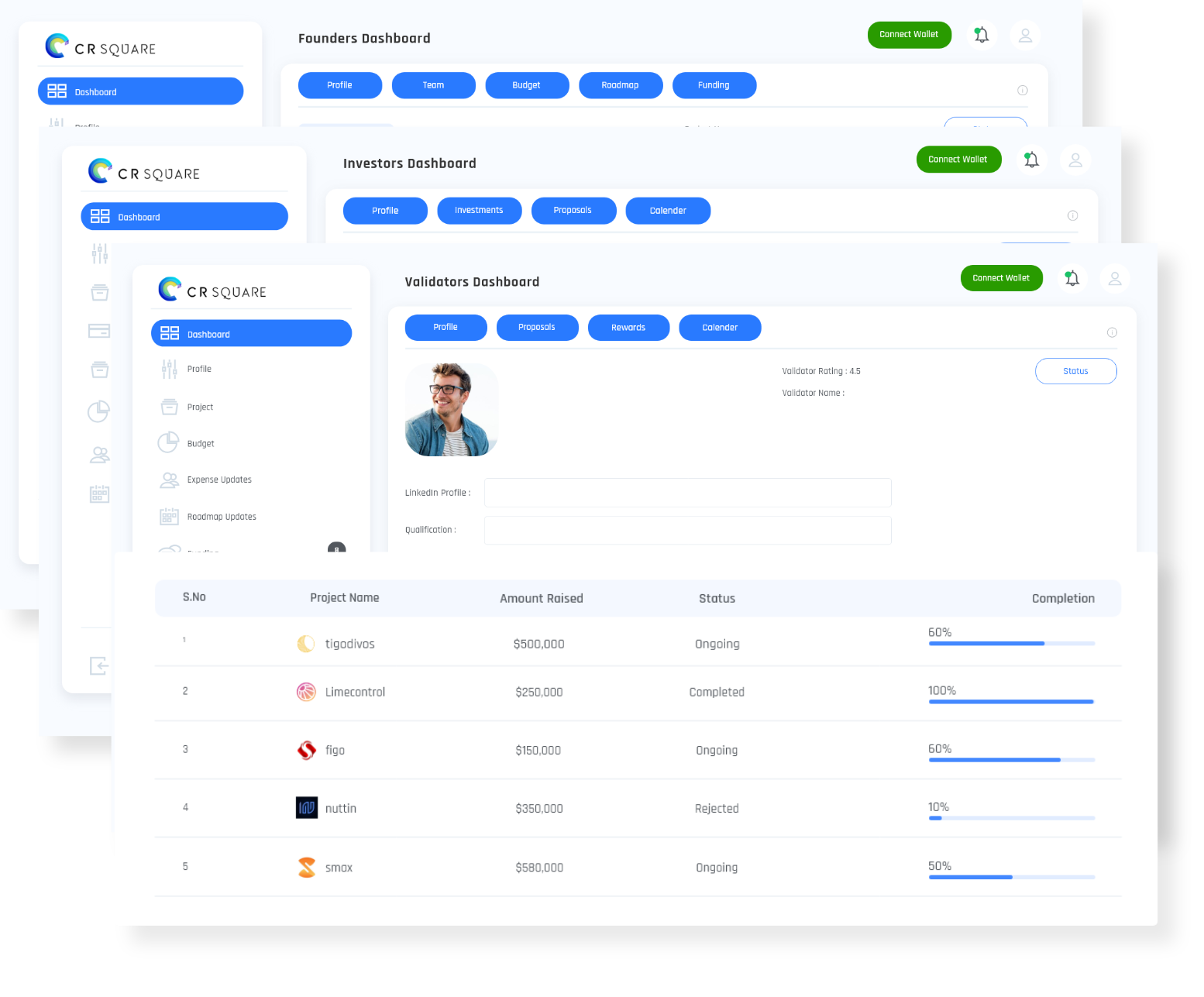

A platform which connects web3 investors and founders and helps in completing entire investment process online on one simple site.

Independent Validation

Experienced personnel in blockchain industry validating projects and milestones without any bias based on majority consensus.

KYC Validation

Founders KYC Validation, limits fraud that result mainly due to hiding of identity eliminating the risk of rug pulls and exit scams.

Vesting Contracts

Founders can release tokens as per vesting schedules to investors, community and team members.

Common Data Room

You can share your project information with the community, investors and peers by way of a unique data room.

Safeguarding Investors Funds

Securing Investor Funds by establishing an oversight over the founder’s progress in product development and fund management with the help of independent third-party validators. Safe guarding the investors funds from rug pulls, founders’ inexperience, whimsical spending, token illiquidity and deviations from the timeline or roadmap by the founders.

Staged Finance

Influx or availability of substantial cash flow at the early stages of the project development can lead to poor treasury management in majority of the cases. Investors in turn lose the potential yields on the idle funds vested with the blockchain projects. Staged Financing subject to the requirements of the blockchain project development facilitated through smart contracts could be the ideal solution presenting more oversight over the project for the investors.

Escrow Mechanism

Staged Financing can create a hesitation among the blockchain start-ups founders as to the guarantee of the future funds from the investors required for blockchain project development. A change in the mind of the Investor for a better investment opportunity can create trouble for the blockchain start-up founders. Hence, Smart Contract based Escrow Pools would be of an ideal choice, which establishes the trust for both the investors and founders.

Independent Validation

Validating authority to independent third parties who are experienced in the fields of accounting, audit, blockchain, development, analysis and management could provide reasonable assurance to the both the founders and the Investors. Further, multiple validator assessments of a single request proposal and approval or rejection based on majority consensus would substantiate the escrow system even further.

Advantages

Outsource Due Diligence

The burden of due diligence before investing every project is drastically cut, as the complete project information is uploaded by the founders on the guardian platform.

Monitor Progress

Inbuilt fund flow and roadmap tracking data would optimize and showcase to the investor the required KPI's to track the status of invested projects.

Immune to Rug Pulls and Exit Scams

With staged financing model powered by smart contract based escrow pool mechanism, investors would have oversight and control over their investments eliminating the possibilities of facing rug pulls or exit scam from founders.

Insure & Hedge

Facility to Insure and hedge against early stage investments in tokenized web3 startups funded through CR Square finance guardian platform.

Enhance Crediblity

Updating founder's KYC, Budget an roadmap data on the guardian platform fulfills 80% of the data requirements of most investor seek for due diligence , which enhances the project's credibility with investors.

Ecosystem Grants

CR Square offers ecosystem grants for projects raising funds through its guardian platform, in addition to automatic debt financing approval for the project's future working capital needs.

Monitor KPI's

Monitor your project's key performance indicators (KPI) on our comprehensive dashboard and enhance your treasury management for overall development of your web3 start up.

Project Validation

Project scoring based on project data updates, independent validator analysis and investor scoring , provides project validation based on majority consensus avoiding individual biases

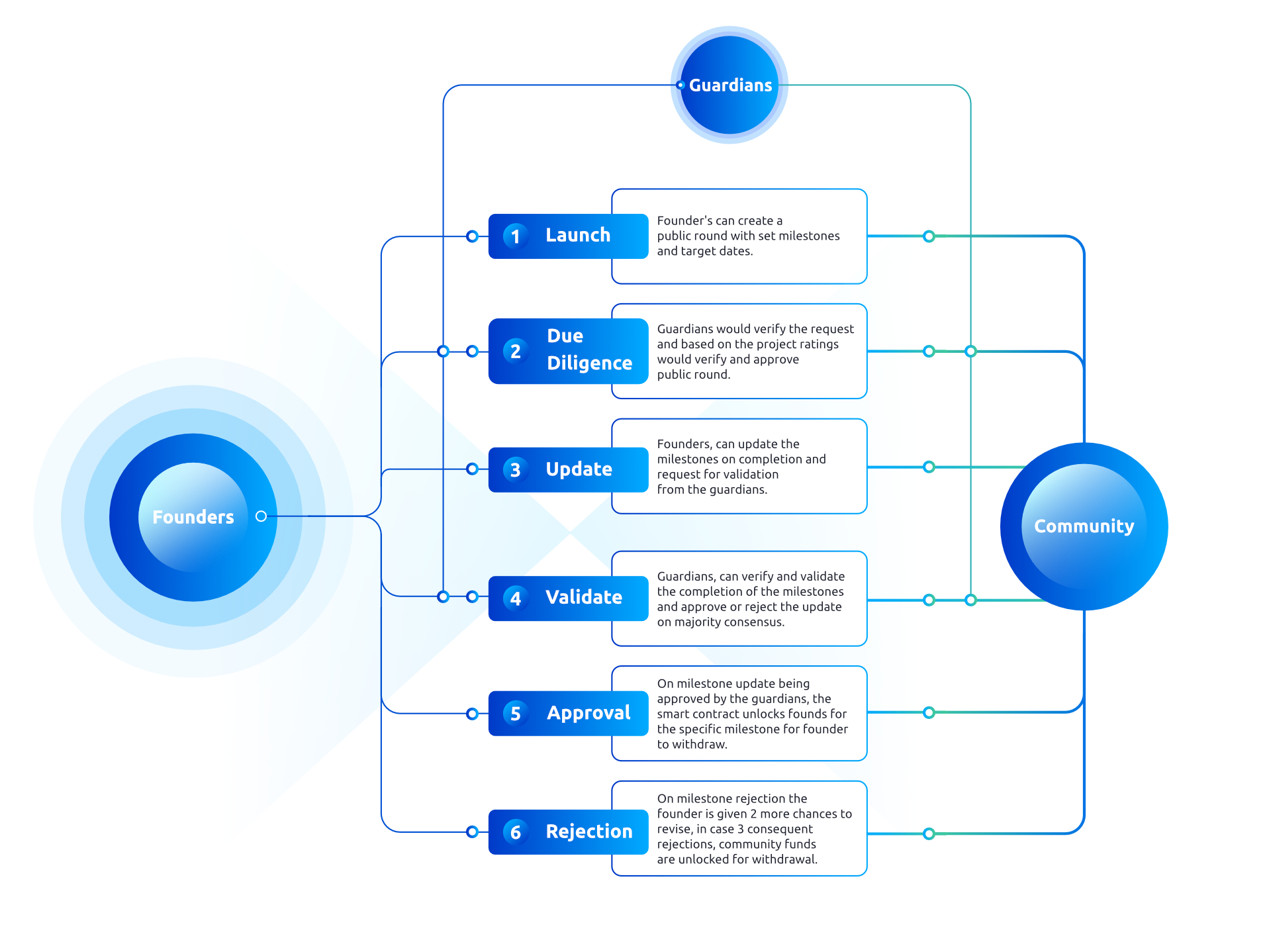

Process Flow

Private Round

Public Round

Follow latest protocol News !

Stay tuned to the developments and progress of the CR Square Ecosystem.